Although there are a range of definitions for Risk Appetite – you won’t find one in the Risk Management Standards ISO 31000:2018 or ISO 31000:2009.

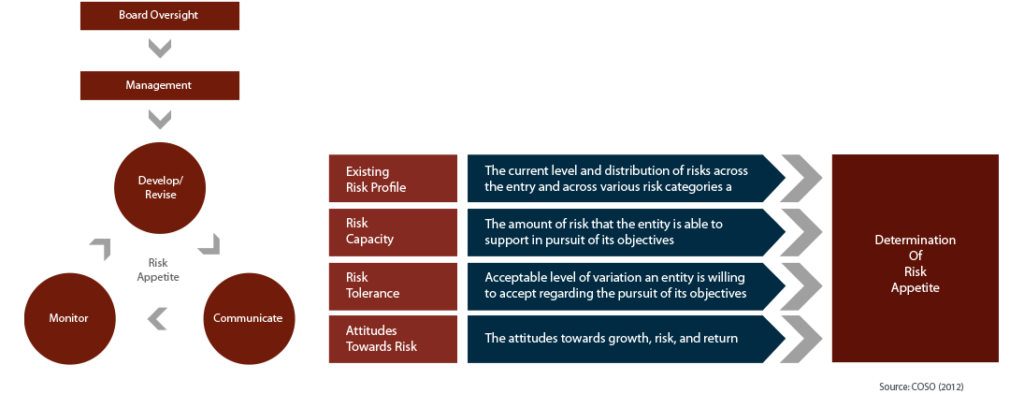

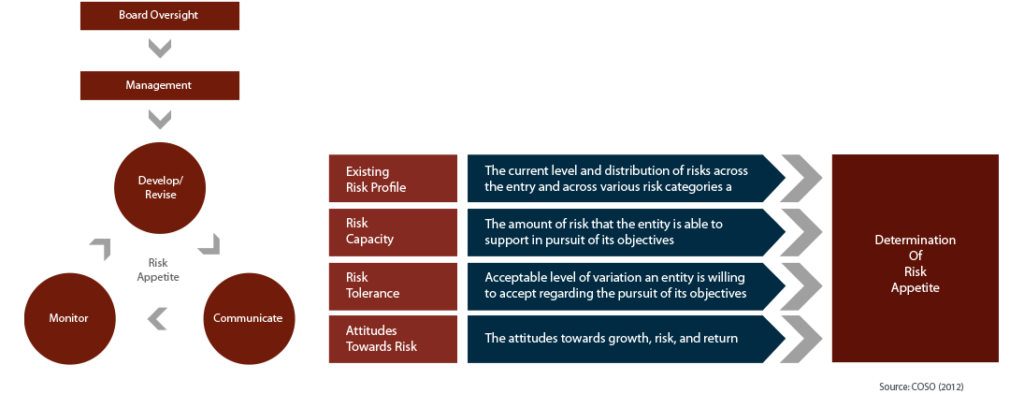

However, risk appetite is generally determined by senior management, based on a number of factors, including:

- Existing risk profile

- Risk capacity

- Risk tolerance

- Attitudes towards risk

Risk appetite for an organisation is typically reviewed and endorsed at the Board level.

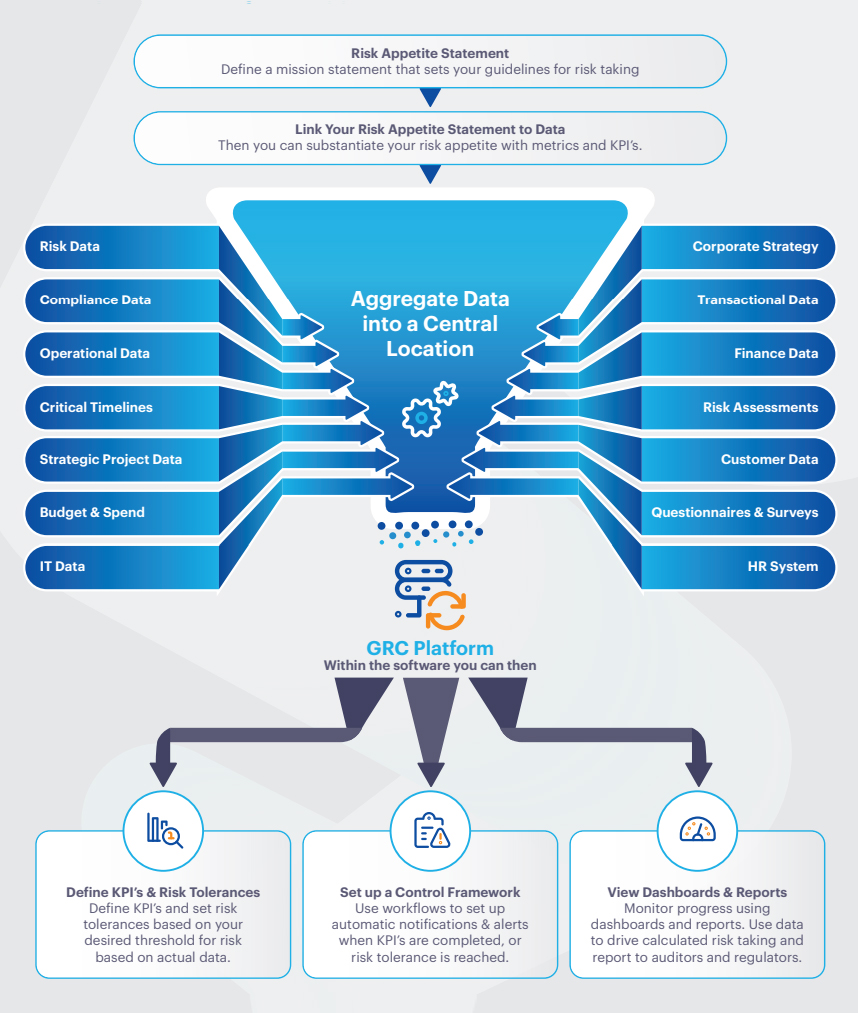

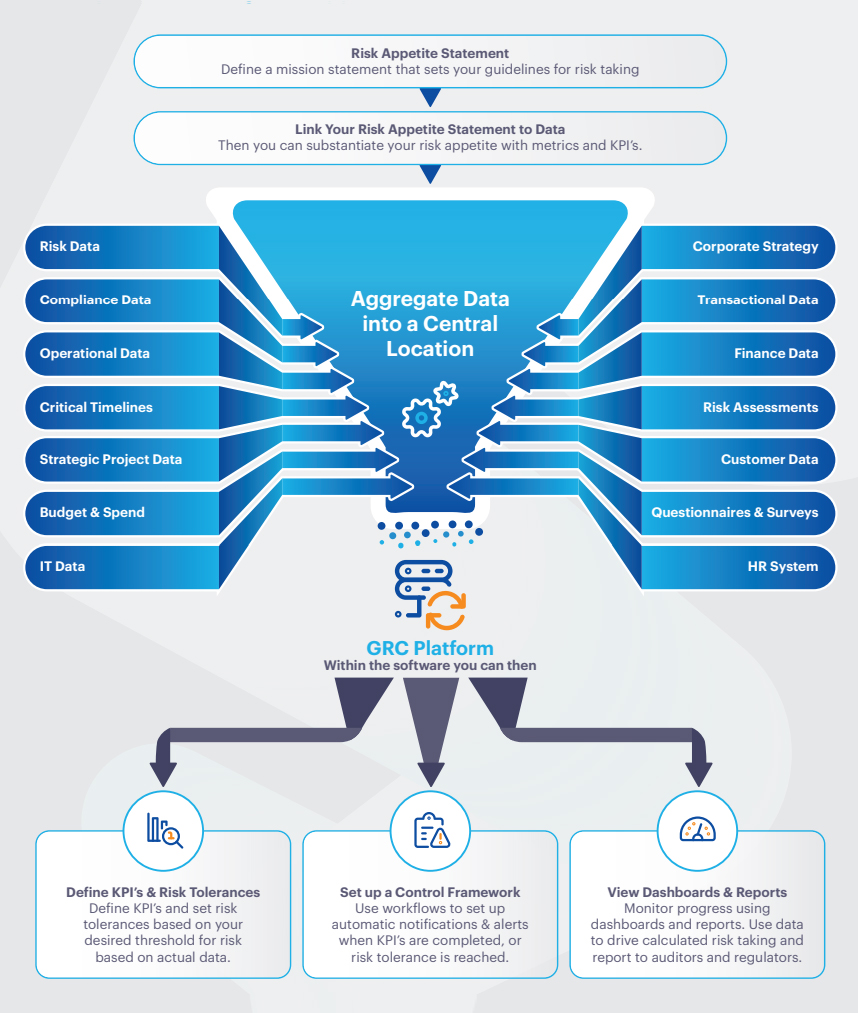

Once an organisation determines its risk appetite, the findings and projections should be drafted into a Risk Appetite Statement. What does that mean?

Risk Appetite Statement

Commonly linked to an organisation’s Risk Framework and sometimes to the Risk Policy, a Risk Appetite Statement identifies the amount and type of risk the organisation is willing to accept for the important categories of risk.

A well-thought risk appetite statement is a useful tool that enables decision-makers within the company to make better ‘risk-informed’ choices.

An organisation’s important risk categories can vary depending on the industry sector and nature of the business. An organisation’s risk appetite can also vary, for the same categories in the same industry sector. This is influenced by a wide range of factors, such as the senior management and Board’s attitude to risk and the maturity or lifecycle phase of the company.

When developing your organisation’s risk appetite statement, it is important to consider all these factors and consult with key stakeholders to ensure relevance and applicability.

To learn more about developing useful risk appetite statements, we encourage you to get in touch with a Camms Consultant, clicking here.

Camms’ software supports risk appetite ratings based on the organisation’s risk categories. Current or residual risk ratings can then be viewed against the respective risk appetite rating and visual icons can then indicate whether it is within or outside of appetite.

Understanding Risk Appetite Terminology

The term Risk Appetite is sometimes confused with Risk Capacity, Risk Tolerance and Risk Target. Let’s take a look at what these respective terms mean.

Risk Capacity – is the total amount of risk the organisation can bear. There’s a slight distinction between this concept and Risk Appetite, where the latter is the amount of risk the organisation is willing to accept. An organisation must first determine its Risk Capacity, prior to determining Risk Appetite.

Risk Tolerance – is the boundaries of risk taking beyond which the organisation is not prepared to go. For example, in the financial risk category, an organisation could set up floor and ceiling values for international finncial transactions against currency fluctuation, and allow business to take place only within that range.

Risk Target – is the desired level of risk the organisation considers optimal. This can determined for an individual risk and may be influenced by the structure of the organisation’s heatmap; for a health and safety risk category the risk appetite may be low, and the residual risk rating high, but the heatmap plots that even if the likelihood is reduced to rare (and the consequence remains the same), the risk rating would be medium.

Benefits of Articulating Risk Appetite

A well-thought-through risk appetite process helps an organisation to:

- Better understand and manage its risk exposure.

- Empower people to make more ‘risk-informed’ decisions.

- Effectively determine priorities and resources for risk actions and controls.

- Improve transparency for investors, regulators and other key stakeholders.

Operationalising Risk Appetite

How Can These Be Configured in Camms.Risk?

Camms’ integrated cloud-based solution is helping businesses to manage risk by setting up a comprehensive risk register, linked to their corporate strategy and compliance obligations. Within Camms.Risk, automatic workflows and alerts link to a defined framework of controls and tolerances to form a complete end-to-end solution for risk management.

Once Camms.Risk is set up for your organisation, your Administrator can add risk appetite benchmark ratings for the corresponding risk category. Risk appetite can then be viewed against residual and target risk ratings in the Risk Register views and also through reports such as the Risk Heatmap.

Head to our webinar for a demonstration on how to set up risk appetite ratings through Camms.Risk, or contact a Virtual Consultant via Virtual Consulting – Camms College to learn why Camms.Risk is the best software out there for an organisation to implement a proven and effective risk management solution.