Types of Risk

Before we dive into Risk Aggregation, let’s briefly review the different types of risks organisations face:

Operational Risk: These are risks associated with the day-to-day operations of an organisation. They include process failures, employee errors, system breakdowns, and more.

Strategic Risk: These risks are related to the organisation’s long-term goals and strategies. They include market volatility, competition, and changes in customer preferences.

Compliance Risk: These risks stem from violations of laws and regulations. Non-compliance can result in legal and financial consequences.

Financial Risk: These risks are tied to financial transactions and investments. They encompass credit risk, market risk, liquidity risk, and more.

Identifying and Assessing Risk

Identifying and assessing risks is the foundation of effective risk management. It involves evaluating the probability and potential impact of various risks on the organisation. Organisations can use Key Risk Indicators (KRIs) and Key Performance Indicators (KPIs) to measure and monitor risks. KRIs focus on measuring changes in exposure to risk, while KPIs assess the degree to which objectives have been achieved.

Risk Aggregation - The Big Picture

Risk Aggregation is the process of combining individual risks to create a comprehensive view of an organisation’s risk landscape. It allows organisations to understand how different risks interact and impact their overall risk profile. Here are the key aspects of Risk Aggregation:

Aggregating Risks: Organisations can link individual risks to create an aggregated view. This is particularly useful when multiple business units face similar risks, and you want to assess them at an enterprise level.

Types of Aggregation: There are different methods of aggregating risks, such as taking the average of linked risk ratings, considering the highest rating among linked risks, or using the most common rating among linked risks. The choice depends on the organisation’s needs.

Reporting: A well-structured Risk Aggregation system should provide easily digestible reports that offer insights into the organisation’s risk posture. This reporting helps in communicating risk information effectively, especially to the board of directors.

Custom Hierarchies: Organisations can use custom hierarchies to group and assess risks across various business units or locations. This is particularly valuable for Workplace Health and Safety (WHS) risks associated with plant and equipment use.

There are many benefits to Risk Aggregation, including:

Improved visibility and understanding of risk: Risk Aggregation provides a holistic view of an organisation’s risk exposure, across all risk categories and business units. This can help decision-makers to better understand the interconnectedness of risks and the potential for cascading failures.

Better decision-making: Risk Aggregation can help decision-makers to make more informed and risk-aware decisions. By understanding the overall risk exposure of the organisation, decision-makers can better allocate resources and make trade-offs between different risks.

Reduced risk: Risk Aggregation can help organisations to reduce their overall risk exposure by identifying and mitigating the most significant risks. By tracking and monitoring risk indicators over time, organisations can detect and respond to emerging risks early on.

Using Risk Aggregation for Informed Decisions

The power of Risk Aggregation lies in its ability to provide a holistic view of an organisation’s risk landscape. Here’s how organisations can leverage it for informed decision-making:

Simplified Reporting: Risk Aggregation simplifies the reporting process by consolidating information from various business units or risk categories into one view. This makes it easier to communicate risk information to stakeholders.

Strategic Insights: By aggregating risks, organisations can gain strategic insights into the most critical risks that need attention. This information informs decision-making and resource allocation.

Risk Mitigation: Risk Aggregation helps in identifying common risk factors and controls that can be applied universally across business units. This streamlines risk mitigation efforts.

Enhanced Communication: The aggregated risk view facilitates better communication between different levels of the organisation, from the operational teams to the board of directors.

Risk Aggregation in Camms Risk

Camms.Risk, empowers organisations to effectively manage their risks. Among its standout features, Risk Aggregation takes centre stage. This process combines individual risks into a unified risk, offering a holistic view of the risk landscape. It’s a game-changer because it unveils how risks interconnect and their potential impact on the organisation.

How to Use Risk Aggregation in Camms Risk

To harness Risk Aggregation in Camms Risk, enable the feature in the application settings. Once activated, you can link risks together at any level within your organisation. For instance, aggregate risks within a specific business unit or across the entire organisation. Camms Risk automatically calculates an overall risk rating when risks are linked.

See our release notes for more on aggregating risks across the enterprise.

Reporting on Risk Aggregation in Camms Risk

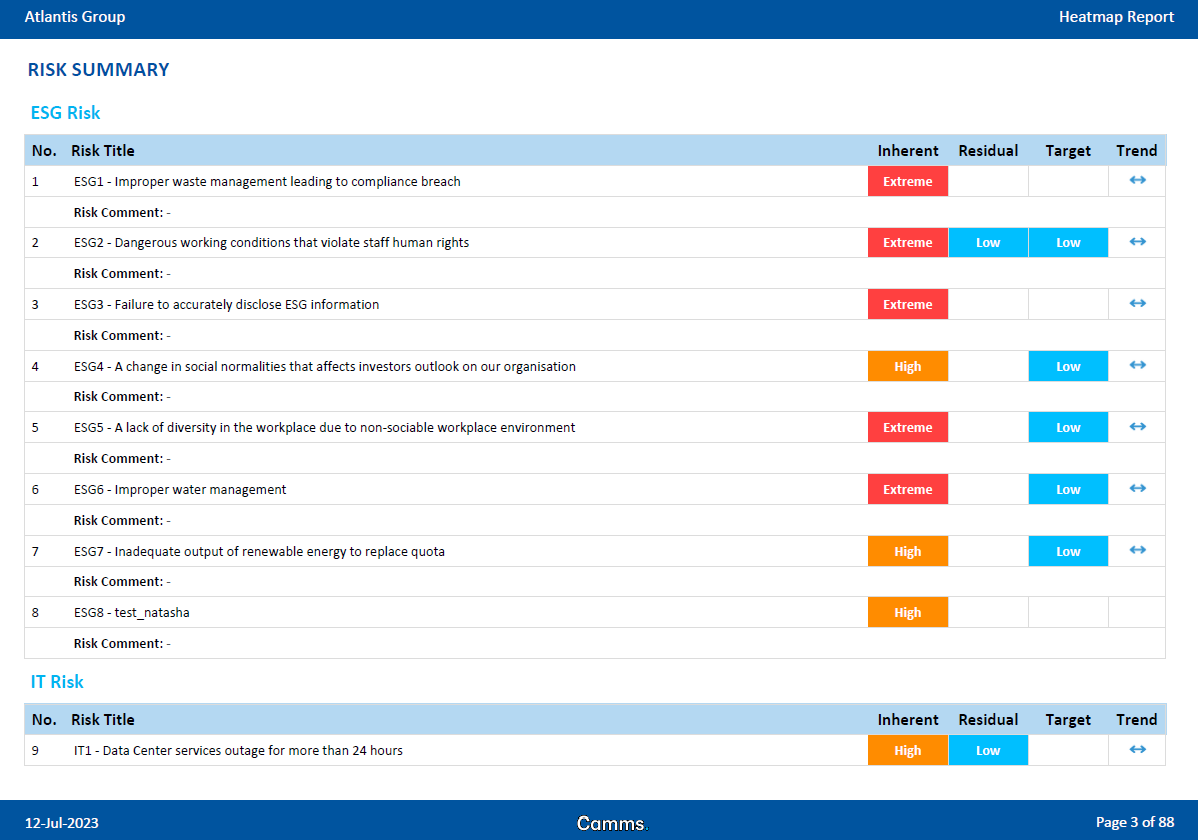

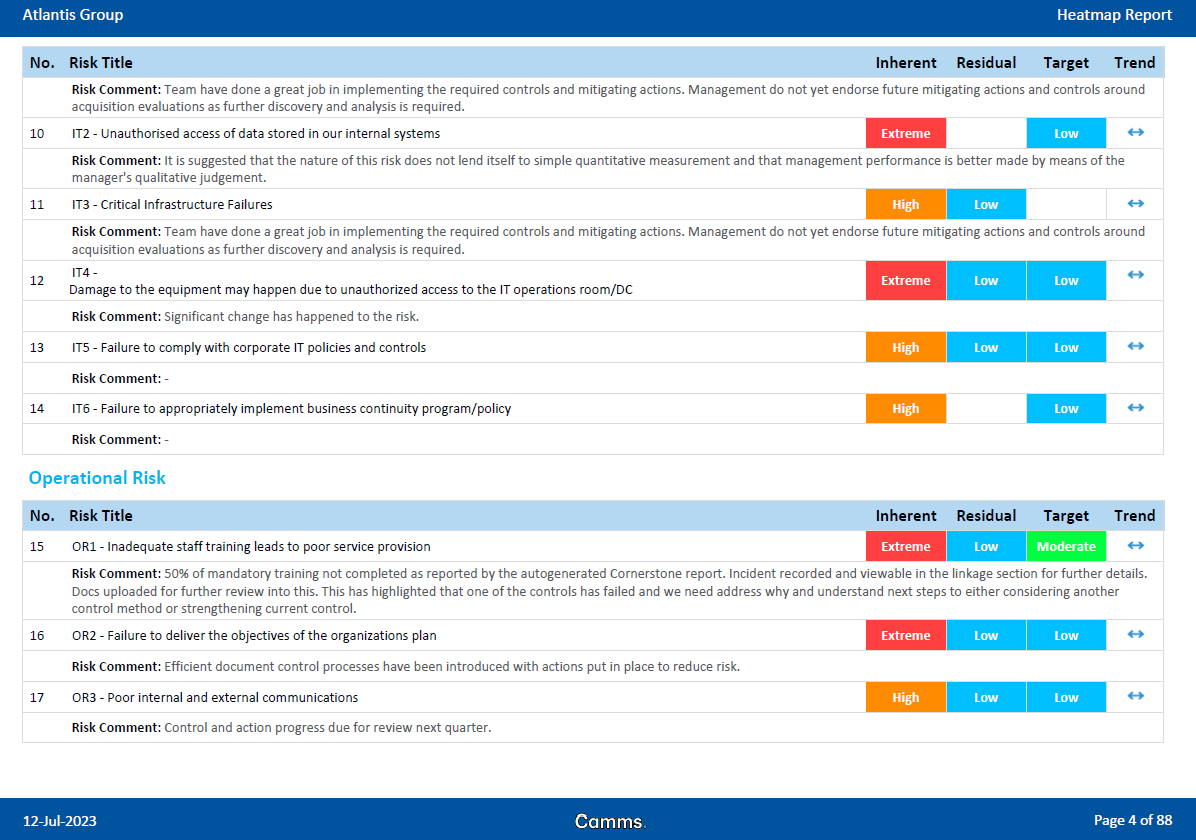

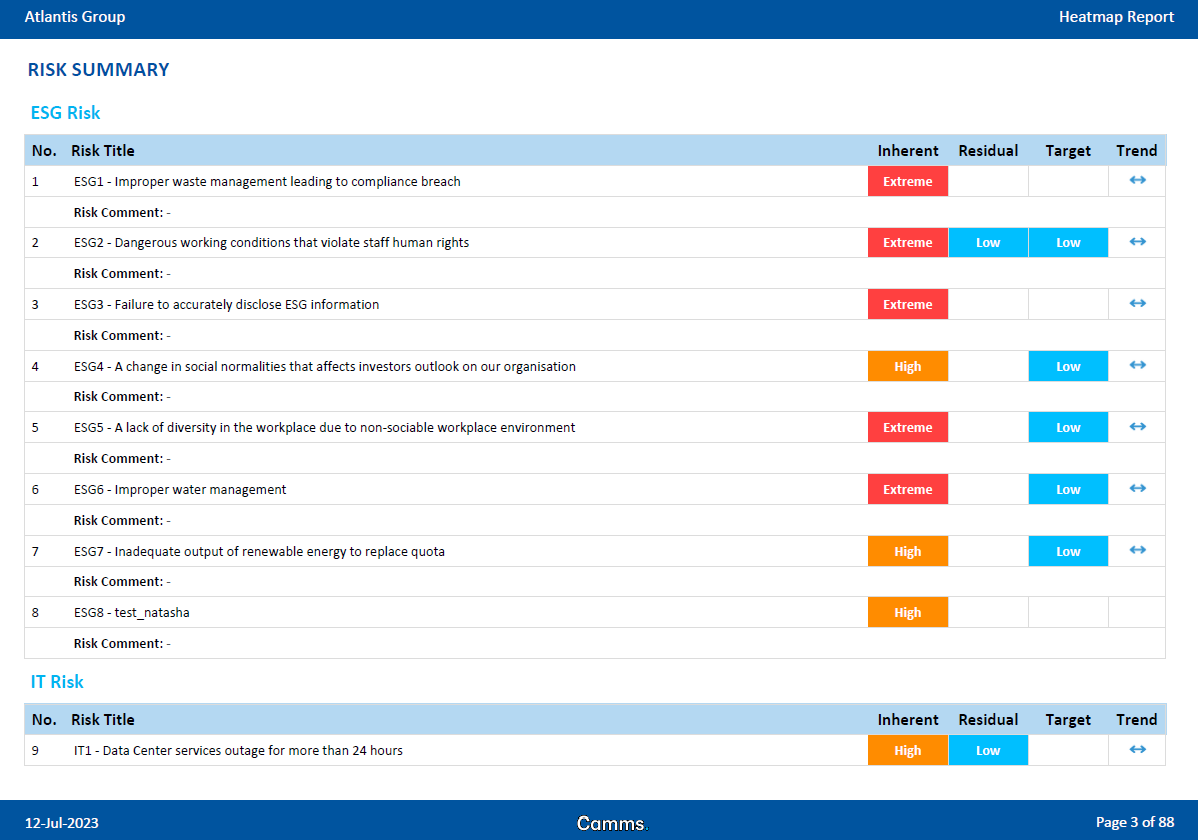

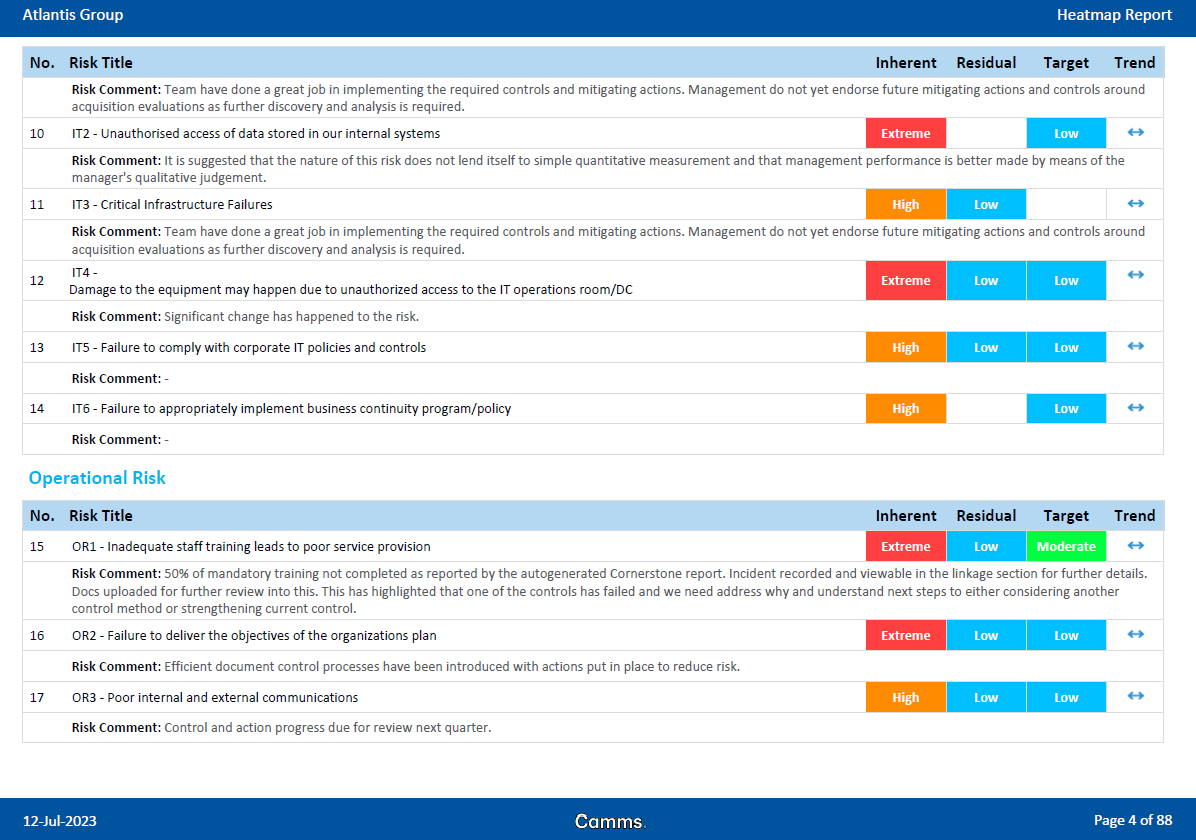

Camms Risk offers various reports to analyse and report on Risk Aggregation. The heatmap report, for instance, displays aggregated risk ratings in a grid format, helping identify high-impact risks.

Additionally, Camms Risk provides reports like the risk register report, risk treatment plan report, and risk overview report to facilitate thorough analysis and reporting on Risk Aggregation.

This report offers a clear and comprehensive view of risk distribution through an easily digestible heatmap format. Following this visualisation, you’ll find a concise risk summary categorised by risk type. To delve deeper into analysis and prioritise critical risks, a detailed risk overview is provided. Furthermore, this report conveniently includes information on Risk Aggregation, all within the same document for your convenience and thorough understanding.

How Risk Aggregation is Used in the Real World

Risk Aggregation is used by organisations in a wide range of industries to improve their decision-making and reduce their overall risk exposure. Here are a few real-world use cases:

Local government can use Risk Aggregation to assess its exposure to a wide range of risks, such as natural disasters, climate change, aging infrastructure, and financial challenges. This information can then be used to make informed decisions about resource allocation, risk mitigation, and public safety.

Banks and financial institutions use Risk Aggregation to assess their exposure to various types of risk, such as credit risk, market risk, and operational risk. This information is used to make decisions about lending, investing, and risk management.

Insurance companies use Risk Aggregation to assess their exposure to underwriting risk. This information is used to set premiums and determine which risks to accept.

Manufacturing companies use Risk Aggregation to assess their exposure to supply chain risk, operational risk, and product liability risk. This information is used to make decisions about sourcing, production, and quality control.

Healthcare providers use Risk Aggregation to assess their exposure to patient safety risk, clinical risk, and financial risk. This information is used to make decisions about patient care, resource allocation, and risk management.

Technology companies use Risk Aggregation to assess their exposure to cybersecurity risk, data privacy risk, and product liability risk. This information is used to make decisions about product development, security measures, and risk management.

Navigating the Complexities of Risk with Risk Aggregation

In today’s fast-paced business environment, understanding and managing risks are paramount. Risk Aggregation offers organisations a powerful tool to gain a holistic view of their risk landscape and make informed decisions. By combining individual risks and utilising GRC software, organisations can streamline the risk management process, enhance communication, and strengthen their overall risk posture. Remember, it’s not about the quantity of risks but the quality of risk management that truly matters.

Schedule a virtual consultation with our experts to explore how Risk Aggregation is revolutionising risk management. Learn how it simplifies complex risks, enhances decision-making, and becomes indispensable in today’s business landscape. Watch our on-demand webinar, Risk Aggregation using Camms.Risk, to gain a deeper understanding of Risk Aggregation and how it can be used to improve your risk management.